Jerry Speltz, Head of U.S. Real Estate Engineering, Barings Real Estate discusses getting it done ahead of Climate Week NYC.

As businesses, governments and other organizations increasingly turn their attention to addressing the urgent climate issues that will almost certainly impact the way we all live, work, and play, the threats posed by rising sea levels should be near the top of the agenda.

There is no longer much debate about whether or not sea levels are rising—they are—they’ve risen by 8 inches globally since 1880; but evidence suggests that this pace is accelerating materially—with some areas along the U.S. east coast and Gulf of Mexico seeing 8-inch rises in the last 50 years alone.

Today, the debate has moved on to “how fast” sea levels will rise from here, and what we can do about it.

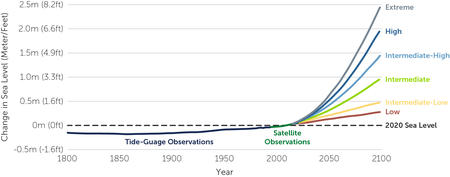

The rate of change is a function of a number of factors, including greenhouse gas emissions, global temperature rises, and the rate of melting ice. The National Oceanic and Atmospheric Administration (NOAA) has summarized the scientific evidence into scenarios that range from a 1-foot sea level rise by 2100 to a roughly 8-foot rise in the ‘extreme’ scenario.

Interestingly, and perhaps counterintuitively, the impact of global sea level rise is unlikely to be equal across regions nor gradual in its progress. Rather, some cities and regions are distinctly more vulnerable than others, and instead of gradual change, the effects of sea level rise will be subject to “tipping points” triggered by such events as major storm surges from hurricanes and the inundation of key infrastructure like ports, highways, bridges and treatments plants.

The size of the problem can be daunting. Eight of the world’s ten largest cities are in or near coastal areas. In the U.S., almost 40% of the population is clustered in high-density coastal areas, which are prone to flooding, shoreline erosion and hazards from storms. Indeed, a recent NASA study indicates that a rise of two feet above today’s sea level would put more than $1 trillion of property and structures in the U.S. at risk of inundation, with roughly half of that exposure concentrated in Florida.

Fortunately, there is hope. Businesses, investors, and governments have increasingly recognized the urgency of the problem and through initiatives like Climate Week NYC, are drawing greater attention to such risks. Additionally, the technology to quantify, assess and predict the potential impact of these risks continues to advance at a rapid pace. Today, we are able to conduct advanced modeling on the effect that sea level rise will have on cities, regions, and even individual properties. The insights we are able to gain from such analysis help us to begin to construct and advocate for solutions. These can include sophisticated solutions like the installation of flood barriers, or so-called “aqua fences,” in high-density areas where such efforts are economically feasible, to “lower tech” solutions, which can include building properties “above code” requirements from the get-go, or partnering with policymakers to modernize and revise zoning regulations.

While such solutions can help to avoid the most dire outcomes, they can also offer potentially profitable long-term investment opportunities for property investors, as the structures that are thoughtfully built with these risks in mind are likely to see strong tenant demand for decades to come. Such an alignment of economic interests is crucial to mobilizing capital for good.

As active and engaged investors in asset classes across public and private markets—including the management of multi-billion dollar global real estate portfolios—we are tasked with understanding and mitigating risks like global sea level rise to help protect our clients’ investments. Similarly, as sponsors of the Finance Program at Climate Week NYC and signatories of the United Nations Principles for Responsible Investment (UNPRI) and the United Nations Global Compact (UNGC), we at Barings are committed to researching and advocating for the changes that are needed to address climate risks, more broadly.

The time for action is now. But in order to succeed, we must do it together.